THE RADISSON AUSTIN NORTH OFFERING IS FULLY SUBSCRIBED.

JOIN THE WAITING LIST

NEW OFFERING

ASAP Holdings, Inc (“ASAP “or “We”) are proud to present the investment opportunity in one of the fastest growing cities in the U.S. – Austin Texas.

VALUE ADD

Converting to a lifestyle boutique unique hotel affiliate with a powerful brand’s distribution will be the perfect value add for this hotel. The lifestyle boutique hotel offers a 4-star trendy interior design, exciting F&B concept, personalize services, large pool with lavish green for pool side party, and amenities to meet the Austin’s mostly younger generation travelers.

INVESTMENT HIGHLIGHT

Location, Location & Location

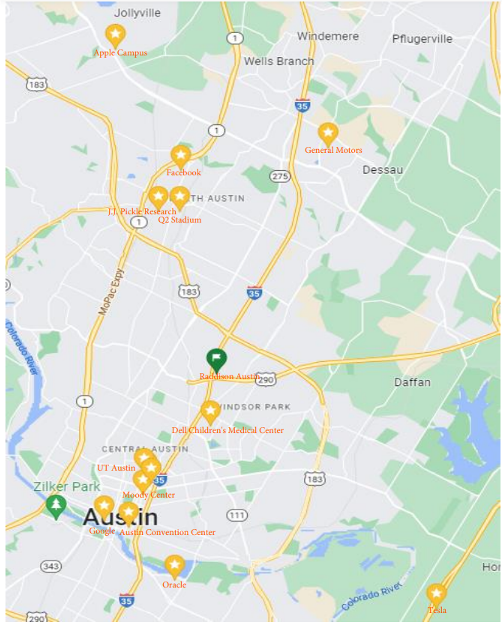

The hotel is located in today’s fastest-growing city in the U.S., Austin Texas. The fee simple interest in a 7.91-acre (344,560 SF) parcel is located at the intersection of two of the busiest freeways (I35 & I290), 6121 North Interstate 35, Austin, Texas 78752. It is also adjacent to the University of Texas, Austin campus as well as 15 minutes away from all the largest employer companies in Austin such as Google, FACEBOOK, Apple, Tesla, Oracle, IBM, GE, Austin International Airport, Downtown, and etc…

Demographic & Housing Shortage

There is a huge housing shortage driving up the median prices of the houses to $550,000 an increase of 20% and the prices for renting have also increased by 32% during the last 2- 3 years. The housing shortage will pricing out many professionals’ willingness to move in to Austin. That is the reason why the City of Austin is eager to increase multifamily FAR to 6X. As it stands now, Austin ranks as the 11th largest city in the country, right behind San Jose, California. But a new projection from the City of Austin indicates that sometime next year, Austin will leapfrog San Jose to claim the No. 10 spot.

City of Austin

Austin has risen to the top of countless measurements in the U.S. including #1 Investment Market, #1 Tech Town, #1 Real Estate Market and #1 Best City for Starting a Business. Already the #3 fastest growing city in the last decade, Austin is projected to grow another 30% by 2029. With in-place growth exceeding that of Silicon Valley by a factor of four, the city is now number one for startup density and non-employer tech business growth.

INVESTORS’ INVESTMENT RETURN

The projected investors return for five years’ hold as:

IRR – 22.5%, Equity Multiple – 2.02x & Cash on Cash Return – 10.29%

Investors’ Waterfall distributions are based upon Available Cash Flow. The conservative projections cash flow in our IRR analysis, after 8% annual preferred return and 100% refund of investors’ investment, the excess Available Cash Flow 50/50 split with LP/GP, LP (investors) should be able to receive equivalent to 8% -16% per annual from 4th year and thereon, while still keep the same percentage of the hotel ownership.

The reasons for this hotel have such great cash flow are: We sold the excess parking lot for $25.75m for a residential developer and reduce the cost of 293 keys hotel for $11.85m ($40k per key), plus $70k per key renovation, makes the overall cost for a brand new 4 stars lifestyle boutique hotel cost less than $120k per key, which are so low compared with the current market value. It will be easy to refinance to cash out our principal in year three and enjoy a strong positive operation cash flow thereafter.

NEARBY RESIDENTIAL GENERATORS

– Moody Center – newly openly April 2022 – 15,000 seats – 150 events annually – 4 miles

– University of Texas – 5 miles (Education, Sports)

– Dell Medical Center – 4 miles

– Dell Children’s Hospital – 2 miles

– Austin Convention Center – 5.1.miles

– SXSW Convention – 5.1 miles

– Q2 Stadium – 5.7 miles

– JJ Pickle Research Center – 5.1 miles

– General Motors – 8 miles

– Consensus International LLC – 1.8 miles

– Easy access to the major East & West I290 and South & North I35 Freeways. Direct access to these freeways allows for a faster commute to downtown and many large companies’ headquarters

Documents

A full Private Placement Memorandum (PPM) summarizing is available upon request for a complete discussion regarding these and other aspects of this investment offering.

Available to Accredited Investors:

- View and print the offering PPM, Subscription Agreement, LLC Operating Agreement, Executive Summary, Investor OM and Term Sheet.

- View and print the Detailed Financial Information and Projections

- Access all of the important documents for this offering in one place

Here is the link and password to view the investor webinar recording,

https://us02web.zoom.us/rec/share/N621UHXRDbDjPsWwYN-PhxgdplETDYbAP4qTgZ-mlkRNFdRDz1YftHLmrOPJVpsE.XElgAUaFG_oBL-_c

Passcode: JX4g=+++